This is written from a UK perspective, as I’m British. It’s basically notes for a talk I’m going to give tomorrow, and probably the largest block of the audience is from the UK. But the points here apply to any country with its own central bank, and especially to the US Federal Reserve.

The “need” for Austerity

The common story of government spending is:

- Government needs to raise money through tax

- It can then spend this money on programmes

- If it needs to spend more money than it can raise, it needs to borrow money

- If it borrows too much, the country is in danger of defaulting on its loans (like Greece)

This is why we needed austerity. “There is no magic money tree”. If we didn’t tighten our purse-strings and massively scale back social support, the country would go bankrupt. This is why we “needed” to cause over 120 thousand excess deaths in underfunding the NHS, and engineer the first drop in life expectancy in 40 years (before COVID).

Why not MMT?

Modern Monetary Theory says this story is complete nonsense - there is a magic money tree:

- The government creates money through spending.

- When the government authorises spending, through legislation or executive actions, the money gets created, one way or another, by the bank

- The government destroys money by claiming it back as tax.

There is significant evidence to support this (or, according to Richard Murphy, it’s an indisputable fact):

- No-one ever spoke about raising tax to cover the £205 billion needed to replace the Trident nuclear submarines

- Government simply spends without much question when it needs to, and the BoE just finds a way to come up with the money

- My Trident example is laughably insignificant compared to US military spending

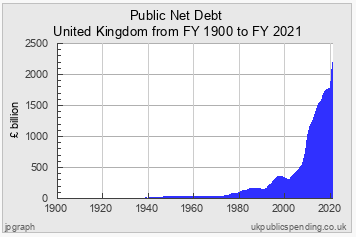

- The UK’s national debt has risen exponentially without consequence

- (⅓ of national debt is owed directly to the Bank of England)

- (the government never has any trouble finding buyers for its debt)

MMT says that the Bank of England is wholly owned by the government of the UK. The Bank of England is the creator and guarantor of all sterling. So the government can simply create money as needed.

An allegory

The best explanation I’ve read of how this works comes from Cory Doctorow (as so many great things do). In “Moneylike”, Cory is actually making the argument that the reason money is needed in the first place is to settle some liability. And that liability is traditionally tax. People need money to pay tax, this is why money exists, and why they need the state to provide it for them:

Sometimes when Mosler is explaining money to an audience, he’ll hold up a handful of his business-cards and ask, “Who will stay after the lecture and help stack the chairs and mop the floor in exchange for one of my cards?

When no hands go up, Mosler adds, “What if I told you that there were gun-toting security guards at the all the exits, and they will only let you leave in exchange for one of my cards?”

Every hand shoots up.

Mosler has just turned his cards into money, through the creation of a non-discretionary door-tax.

Now, Mosler didn’t need to get his business-cards from the audience before he could levy this tax. He is the sole supplier of his cards, and while the audience will treat them as money, Mosler won’t. Mosler doesn’t need business-cards — he needs people to help clean the lecture hall and stack the chairs. At the end of the night, when the security guards turn over all the collected cards to him, he doesn’t need them — he can’t pay for his airfare to the next lecture using his cards, or pay for his hotel room with them. Indeed, given how cheap business cards are to produce, he can just dump all those used cards in a shredder.

When people say, “Government budgets aren’t like household budgets,” this is what they mean. Mosler isn’t a currency user in this thought-experiment, he’s a currency issuer. Mosler needs your work, not your “money.” He has all the money (Mosler’s business cards). You can’t get money (Mosler’s business cards), except from Mosler. When you pay your door-tax to Mosler’s armed agents, you aren’t giving him your money — you’re giving him his own money back.

(As an aside, the actual point of Cory’s article is to argue that cryptocurrency isn’t really very “moneylike” because there’s no liability that you need crypto to fulfil. This is why it remains a speculative asset. And the reason those who push Web 3 want it so badly is because it would provide a liability to justify the existence of Crypto. You’d need Crypto to access the Internet. An internet tax.)

How money is created

The mechanisms of government spending are complicated. Unnecessarily so. This is financial theatre.

How government finances spending:

- Running up debt which it never pays off

- Lend more money to commercial banks

- Quantitative easing

- The ways and means account

Implications of MMT

- Spending is not funded through tax, it’s independent of tax. Tax is a mechanism for controlling the flow of money through the economy - e.g. for combating inequality (tax the rich); or inflation (tax the big spenders so they can’t spend)

- The true limits on government spending lie in the productive capacity of the country.

- If the government gives tons of money in tax breaks to 10,000 bankers who all now want to buy new luxury cars, but the country can only produce 300 luxury cars a year, then we have a problem. This would lead to demand-side inflation of the price of luxury cars.

- But if the government spends money employing people to build luxury cars, the rate at which the country can produce luxury cars would increase instead.

- The government can only employ people if there are people looking for work. So spending of this sort is limited by Full Employment. This is why many MMT theorists support a job guarantee.

- (Business would prefer not to have full employment, because if work is easy to find, workers are in more demand and have more power. If workers have more power, they will demand better salaries)

- If the government is not spending enough to create full employment then it is monopolising and exploiting the country’s resources.

This really matters

Under successive Conservative governments, and even the under New Labour to a lesser extent, public spending has been tight, leaving people to fend for themselves. This has caused a huge amount of suffering (and a loose labour market where corporations have all the power).

Hope?

Times they are a-changing somewhat:

UK central bank becomes first in the world to adopt direct monetary financing to fund government spending during the coronavirus crisis

I think it’s quite possible that the rise in acceptance of MMT (even though it’s still not mainstream) genuinely helped governments across the world justify spending large amounts of money on COVID measures and relief. Of course it could have been better, but it could also have been much worse.

However, even Labour are still peddling the “no magic money tree” line.

Some great resources on this

- https://positivemoney.org/

- https://twitter.com/richardJMurphy/ & http://www.taxresearch.org.uk/Blog/

Appendices

Banks create money out of thin air

When licensed banks lend money, they create it out of thin air by simply writing number in your account. They only keep a fraction of the funds they lend out in reserve. This fraction is defined through legislation, differently for each central bank.

The ECB is in trouble

The same theory is broadly true even for the European Central Bank, but because the ECB sets the financing restrictions for 19 countries, this is fraught with peril and conflict. Especially during times of need like COVID. The ECB has a problem.